An Overview under UAE Corporate Tax, International Accounting Standard (IAS24) & International Standard on Auditing (ISA 550)

Related parties” is a term used across various disciplines in business, particularly in accounting, auditing, and finance, to describe relationships where one party has the ability to exert significant influence over the management or financial decisions of another. When there is a possibility of influencing one party by the another, it is natural that the Authorities and the Stakeholders of the business demand more compliance and transparency with the transactions amongst these parties. The transactions between related parties are scrutinized differently than transactions with unrelated parties primarily due to their potential impact on financial fairness and transparency. Therefore, understanding on how related parties and their transactions are treated across various domains like UAE Corporate Tax, International Accounting Standards and International Standards on Auditing is crucial for maintaining compliance and transparency in business operations.

This article is divided into 3 sections covering:

- A. Related Parties and UAE Corporate Tax (CT)

- B. Related parties and International Accounting Standards (IAS 24 – Related Party Disclosures)

- C. Related parties and Standards on Auditing. (ISA 550, “Related Parties”)

The narratives are mainly to include the identification, compliance, governance, reporting, transparency, and fairness which needs to be maintained and ensured while the business has related parties’ transactions. This comprehensive analysis will cover the identification of related parties, the treatment and disclosure of related party transactions, and their broader impact, along with a discussion on various statutory compliance requirements.

SECTION – A Related Parties And UAE Corporate Tax

Who Is A Related Party Under CT ACT

Related Parties Includes (Article 35)

- Two or more natural persons who are related within the fourth degree of kinship, or affiliation, including by way of adoption or guardianship.

- Natural person and a juridical person where: The natural person or its Related parties are shareholders in the juridical person , and they own 50% or greater ownership interest in the juridical person; or the natural person with its Related Parties Controls the juridical person.

- Two or more juridical persons where one juridical person; one juridical person with its Related Parties Controls the other juridical person; Any person with its Related Parties owns 50% or greater ownership interest in or Controls such two or more juridical persons.

- A Person and its Permanent Establishment or Foreign Permanent Establishment

- Partners in the same Unincorporated Partnership

- A Person who is the trustee founder, settlor or beneficiary of a trust or foundation , and its Related Parties.

Control

- Ability to exercise 50% or more of the voting rights

- Ability to determine the composition of 50% or more of the Board of directors

- Ability to receive 50% or more of the profits

- Ability to determine, or exercise significant influence over, the conduct of the Business and affairs

First Degree of Kinship and affiliation includes:

- Spouse

- Parents of Natural Person

- Parents of Natural Person’s spouse

- Children of Natural Person

- Children of Natural Person’s spouse

Second Degree of Kinship and affiliation includes:

- Grand parents of Natural Person

- Grand Children of Natural Person

- Brothers/sisters of Natural Person

- Grand Parents of Natural Person’s spouse

- Grand Children of Natural Person’s spouse

- Brothers/sisters of Natural Person’s spouse

Third Degree of Kinship and affiliation includes:

- Great-Grandparents of Natural Person

- Great-Grand Children of Natural Person

- Brothers/sisters of Natural Person’s parents

- Great-Grand Parents of Natural Person’s spouse

- Great-Grand Children of Natural Person’s spouse

- Brothers/sisters of parents of Natural Person’s spouse

- Children of Brothers/sisters of parents of Natural Person’s spouse

Fourth Degree of Kinship and affiliation includes:

- Great-Great-Grandparents of Natural Person

- Great-Great-Grand Children of Natural Person

- Brothers/sisters of Natural Person’s Grandparents

- Grand Children of Natural Person’s Brothers/sisters

- Children of brothers/sisters of Natural Person’s parents

- Great-Great-Grandparents of Natural Person’s spouse

- Brothers/sisters of Grandparents of Natural Person’s spouse

- Grand Children of brothers/sisters of Natural Person’s spouse

Further, the UAE CT Law, also mentions about Connected Persons, which includes:

(a)an owner of the entity, (b)director or officer of the entity or (c)2 related party of (a) and (b)

Transactions With Related Parties – Transparency And Compliance Under CT Law

Following are the key summarized aspects to be kept in mind while assessing the related party transactions under CT Law.

- In determining Taxable Income, transactions and arrangements between Related Parties must meet the arm’s length standard.

- Arm’s length standard is met if the results of the transaction or arrangement are consistent with the results that would have been realized if Persons who were not Related Parties had engaged in a similar transaction or arrangement under similar circumstances. In simple terms, related party transactions are said to be at Arm’s length when it matches all the characteristics of a non-related party transaction, under similar conditions.

- In order to ensure the related party transactions are at Arm’s length, a pricing methodology is developed internationally, which is accepted world-wide by the Governments, Accounting Bodies and various such authorities. This pricing of transactions or arrangements between Related Parties or Connected Persons that are influenced by the relationship between the transacting parties are called as Transfer Pricing.

- For example, an owner/shareholder of a business will be able to deduct their salary when determining the Taxable Income of the Company, but only insofar as this salary corresponds with the Market Value. To determine if the value of a service or benefit provided matches its Market Value, the arm’s length principle should be applied.

- There are various transfer pricing methods to determine the Arm’s length principle (ALP)

- (a) The Comparable uncontrolled price method.

- (b) The resale price method.

- (c) The cost-plus method.

- (d) The transactional net margin method.

- (e)The transactional profit split method.

- The Tax Authority examines whether income and expenditure resulting from a taxable person’s relevant transaction or arrangement with the related parties, meet the arm’s length standard based on the transfer pricing method employed and its appropriateness. If the result of the transaction does not fall within the arm’s length price range, the Authority adjusts the taxable income of the taxable person to achieve the arm’s length result that best reflects the facts and circumstances of transaction or arrangement.

- As part of the Compliance Requirements under CT law, the specified Companies are required to maintain various Transfer Pricing Documentations as well.

To conclude, the introduction of the Corporate Tax (CT) regime in the UAE marks a significant shift in how businesses must handle related party transactions. Historically, many UAE companies might not have maintained stringent records or adhered to formalized practices for these transactions, primarily due to the lack of a comprehensive tax framework or any other mandatory requirements. However, with the implementation of CT, there is a heightened emphasis on compliance, transparency, and accountability. Under the UAE CT law, the arm’s length principle is central to related party transaction regulations. These principals mandate that the terms and conditions of transactions between related parties should be equivalent to those that would have been made with unrelated parties under similar circumstances. This is critical for maintaining transparency, preventing tax evasion, and ensuring fairness in financial reporting and tax obligations. For businesses, adhering to these new regulations is not just about compliance; it’s about ensuring fair and transparent business practices that can sustain long-term growth and stability.

SECTION – B Related Parties And International Accounting Standards

IAS 24 – RELATED PARTY DISCLOSURES

Introduction

IAS 24, “Related Party Disclosures,” sets out the requirements for disclosing information about transactions and outstanding balances between a reporting entity and its related parties. Related party relationships can have a significant impact on an entity’s financial position and performance, which is why transparency in reporting is crucial.

Objectives of IAS 24

The primary objective of IAS 24 is to ensure that an entity’s financial statements provide users with sufficient information to understand the nature and extent of its relationships with related parties and the effects of those relationships on its financial position, financial performance, and cash flows.

Who are related parties?

A related party is a person or entity that is related to the entity that is preparing its financial statements (referred to as the ‘reporting entity’).

- (a) A person or a close member of that person’s family is related to a reporting entity if that person:

- has control or joint control over the reporting entity.

- has significant influence over the reporting entity; or

- is a member of the key management personnel of the reporting entity or of a parent of the reporting entity.

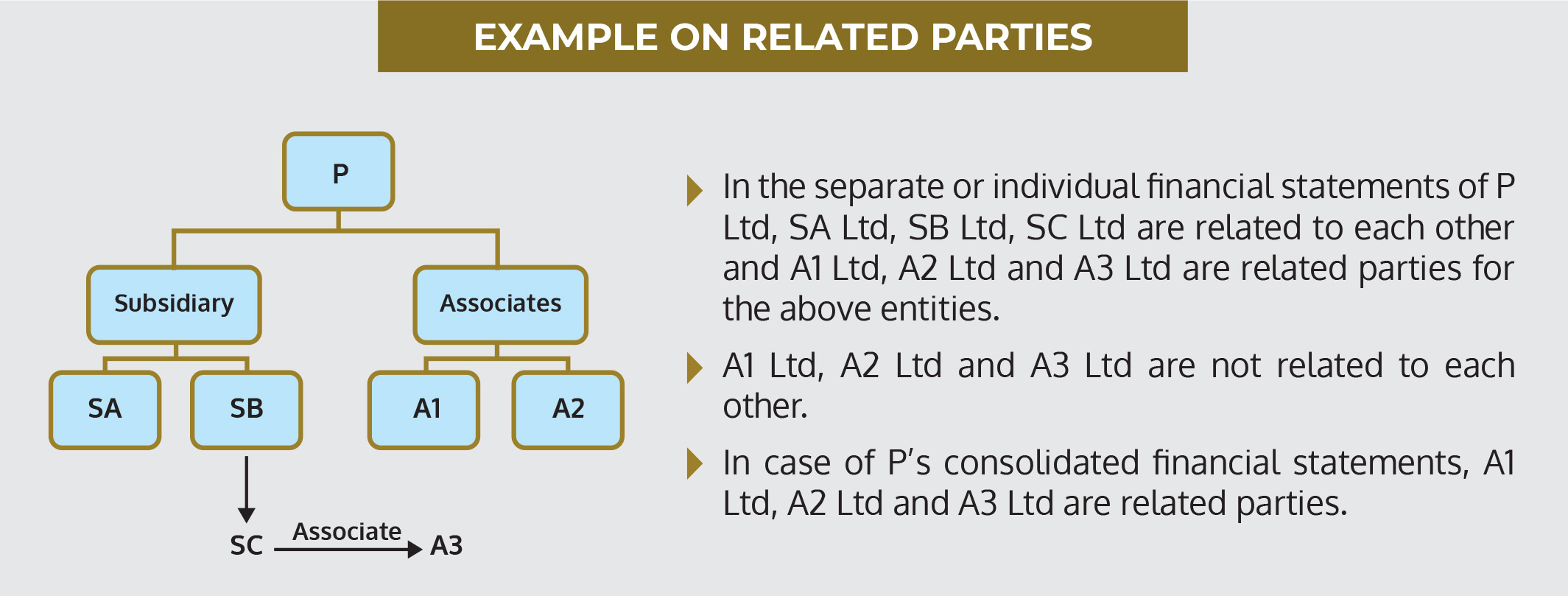

- (b) An entity is related to a reporting entity if any of the following conditions applies:

- The entity and the reporting entity are members of the same group (which means that each parent, subsidiary, and fellow subsidiary is related to the others).

- One entity is an associate or joint venture of the other entity (or an associate or joint venture of a member of a group of which the other entity is a member).

- Both entities are joint ventures of the same third party.

- One entity is a joint venture of a third entity, and the other entity is an associate of the third entity.

- The entity is a post-employment defined benefit plan for the benefit of employees of either the reporting entity or an entity related to the reporting entity. If the reporting entity is itself such a plan, the sponsoring employers are also related to the reporting entity.

- The entity is controlled or jointly controlled by a person identified (a)

- A person identified in (a)(i) has significant influence over the entity or is a member of the key management personnel of the entity (or of a parent of the entity).

- The entity, or any member of a group of which it is a part, provides key management personnel services to the reporting entity or to the parent of the reporting entity.

clas-“no-listing”

Who are not related parties

The standard clarifies that certain standards are not related party relationships. They are:

- (a) Two entities are not related parties simply because they have a director or other member of a key management personnel in common or because of key management personnel of one entity has significant over the other entity

- (b)Two venturers are not related parties simply because they share joint control over a joint venture

- (c)providers of finance, trade unions, public utilities, and departments and agencies of a government that does not control, jointly control or significantly influence the reporting entity, simply by virtue of their normal dealings with an entity (even though they may affect the freedom of action of an entity or participate in its decision-making process)

- (d) a single customer, supplier, franchiser, distributor, or general agent with whom an entity transacts a significant volume of business merely by virtue of the resulting economic dependence

Understanding related party transactions

A related party transaction is a transfer of resources, services, or obligations between related parties, regardless of whether a price is charged.

Examples of related party transactions are:

- (a) Purchase or transfer or sale of goods

- (b) Purchase or transfer or sale of property and other assets

- (c) Rendering or receiving of services

- (d) Leases

- (e) Transfers of research and development

- (f) Transfers under license agreements

- (g)Transfers under finance arrangements (including loans, equity contributions in cash or kind)

- (h) Provision of guarantees or collateral

- (i) Settlement of liabilities on behalf of the entity or by the entity on behalf of that related party

- (j) Commitments to do something if a particular event occur or does not occur in the future,

including executory contracts - (k) Management contracts for deputation of employees if any

Disclosure as per IAS 24

The disclosure requirements can be broadly classified in to two categories.

- Category 1 requires disclosures of relationships even though there are no related party transactions between the disclosed related parties.

- Category 2 requires disclosures of relationships and transactions only when there are related party transactions.

Category 1: Relationships between parents and subsidiaries.

Regardless of whether there have been transactions between a parent and a subsidiary, an

entity must disclose the name of its parent and, if different, the ultimate controlling party. If

neither the entity’s parent nor the ultimate controlling party produces financial statements

available for public use, the name of the next most senior parent that does so must also be

disclosed.

Category 2: Remuneration to Key management personnel and other related party

transactions

An entity is required to disclose total compensation paid to key management personnel and

compensation by each of the following categories:

- Short-term employee benefits,

- Post-employment benefits,

- Other long term benefits

- Termination benefits

- Share-based payment benefits

Key management personnel are those persons having authority and responsibility for planning, directing, and controlling the activities of the entity, directly or indirectly, including any directors (whether executive or otherwise) of the entity.

Other related party transactions: If there have been transactions between related parties, disclose the nature of the related party relationship as well as information about the transactions and outstanding balances necessary for an understanding of the potential effect of the relationship on the financial statements. These disclosures would be made separately for each category of related parties and would include:

- the amount of the transactions the amount of outstanding balances,

- including terms and conditions and guarantees

- provisions for doubtful debts related to the amount of outstanding balances

- expense recognized during the period in respect of bad or doubtful debts due from related parties

In a nutshell, the IAS 24 requires entities to disclose relationships with related parties and transactions and outstanding balances with such parties. The intent is to provide financial statement users with the information necessary to draw conclusions about the potential effects of related party relationships on the entity’s financial position and performance. As part of compliance and governance, under IAS 24, organizations must report the nature of the related party relationship as well as information about the transactions, outstanding balances, and commitments in their financial statements. The aim is to ensure sufficient transparency to enable users to assess the influence of related parties on an entity. The disclosure of related party transactions under IAS 24 enhances the transparency and comparability of financial statements. It helps stakeholders assess the integrity of the financial reports and the fairness of the transactions, particularly in contexts where related party transactions might be used to manipulate earnings or transfer resources out of the company at non-market terms. Thus, IAS 24 enables a user of the financial statement to correctly evaluate the Company’s position and performance with respect to the related parties.

SECTION – C Related Parties And Standards On Auditing

ISA 550, “Related Parties”

Introduction

International Standard on Auditing (ISA) 550, “Related Parties,” is a critical component of the auditing standards, providing guidance on how auditors should approach and address related party transactions and relationships in their audits. Related party transactions and relationships can significantly impact an entity’s financial statements, and ISA 550 helps auditors ensure these are appropriately identified, disclosed, and evaluated.

Many related party transactions are in the normal course of business. In such circumstances, they may carry no higher risk of material misstatement of the financial statements than similar transactions with unrelated parties. However, the nature of related party relationships and transactions may, in some circumstances, give rise to higher risks of material misstatement of the financial statements than transactions with unrelated parties. For example:

- Related parties may operate through an extensive and complex range of relationships and structures, with a corresponding increase in the complexity of related party transactions.

- Information systems may be ineffective at identifying or summarising transactions and outstanding balances between an entity and its related parties.

- Related party transactions may not be conducted under normal market terms and conditions; for example, some related party transactions may be conducted with no exchange of consideration.

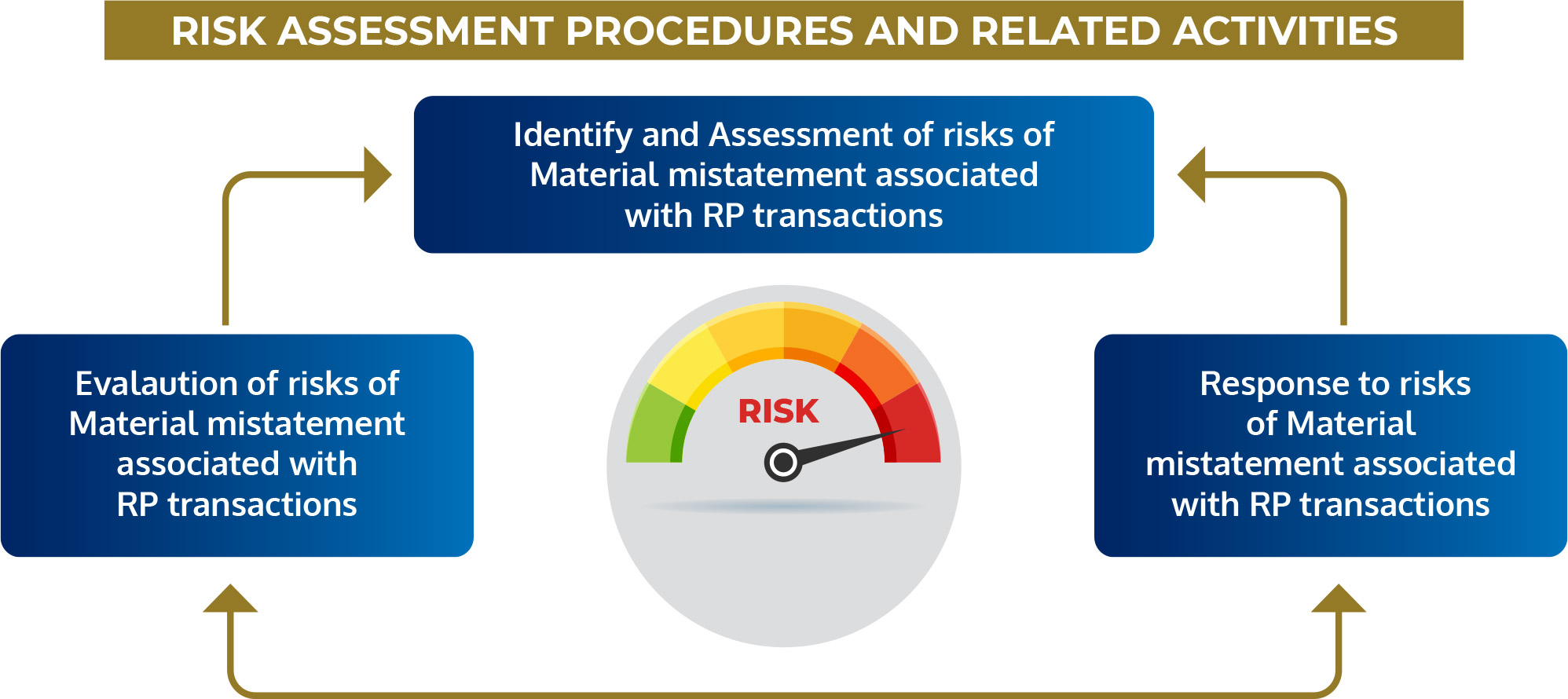

Responsibilities and objectives of the Auditor

Identification of related-party relationships and transactions ISA 550 requires the use of a risk-based approach to the audit of related parties and transactions to:

- recognize fraud risk factors, if any, arising from related party relationships and transactions that are relevant to the identification and assessment of the risks of material misstatement due to fraud; and

- conclude, based on the audit evidence obtained, whether the financial statements, insofar as they are affected by those relationships and transactions

- Identity of related party

- Nature of relation with them

- Whether any transactions occurred during the relevant period

- Whether properly disclosed as per applicable financial reporting framework

- Shall take all confirmations as an indication of existence of related party

- If seems outside normal course of business, to enquire about the nature of such transactions

- If the auditor identifies arrangements or information that suggests the existence of related party relationships or transactions that management has not previously identified or disclosed to the auditor, the auditor shall determine whether the underlying circumstances confirm the existence of those relationships or transactions

- If the auditor identifies related parties or significant related party transactions that management has not previously identified or disclosed to the auditor, the auditor shall: (a) Promptly communicate the relevant information to the engagement team

- Where the applicable financial reporting framework establishes related party requirements:

- Request management to identify all transactions

with the newly identified related parties for the

auditor’s further evaluation; and - Request management to identify all transactions

with the newly identified related parties for the

auditor’s further evaluation; and

Inquire as to why the entity’s controls over related

party relationships and transactions failed to

- Request management to identify all transactions

- (a)They have disclosed to the auditor the identity of the entity’s related parties and all the related party relationships and transactions of which they are aware; and

- (b)They have appropriately accounted for and disclosed such relationships and transactions in accordance with the requirements of the framework.

(a) Achieve fair presentation.(b) Are not misleading.

obtain sufficient appropriate audit evidence to conclude whether related party transactions are properly identified, accounted, and disclosed in the financial statements.

Going detailed in the perspective of an auditor, the auditor shall enquire the management:

Evaluation

The auditor shall identify and assess the risks of material misstatement associated with related party relationships and transactions and determine whether any of those risks are significant risks. In making this determination, the auditor shall treat identified significant related party transactions outside the entity’s normal course of business as giving rise to significant risks.

If the auditor identifies fraud risk factors (including circumstances relating to the existence of a related party with dominant influence) when performing the risk assessment procedures and related activities in connection with related parties, the auditor shall consider such information when identifying and assessing the risks of material misstatement due to fraud in accordance with ISA 240

Response to assessed risks

Written Representations

The auditor shall obtain written representations from management and, where appropriate, those charged with governance that:

In essence, ISA 550 governs how auditors should approach related parties in financial audits and directs the auditor’s focus toward the risk of significant misstatements that could arise from related-party relationships and transactions. The standard highlights the need to consider these factors during planning and particularly in risk assessment. Specific procedural requirements are outlined, prompting auditors to review their practices to ensure compliance. ISA 550 offers precise guidance for auditing this complex and crucial area. As part of compliance and governance, the auditors must perform specific procedures to identify, assess, and respond to the risks of material misstatement due to fraud or error associated with related party transactions. This includes assessing whether the transactions were conducted under terms typical of arm’s length transactions and if they were appropriately authorized and approved by those charged with governance.

Conclusion:

The treatment of related parties and their transactions under UAE Corporate Tax and IAS 24, highlights a global commitment to transparency, compliance, and fairness in financial reporting and taxation. Understanding the nuances of related party transactions and adhering to the CT law and to the Standard, is crucial for maintaining the integrity of financial reporting and meeting compliance obligations. Aligning and integrating the accounting practices related to related party transactions, across UAE Corporate Tax regulations and IAS 24 is pivotal for enhancing governance and oversight in organizations. This integration helps in building a robust framework for the management of related party transactions, significantly reducing the risks of financial misstatements and non-compliance with tax laws.

We're here to help you thrive.

Boost Your Company’s ICV Score With Your Sustainability And Technologies, Strategies, Actions And Goals

Learn moreDUBAI

Suite No. 327 & 309,

P.O Box 52258,

City Bay Business Centre,

Abu Hail

ABU DHABI

Suite No: 1601,

P.O Box 25929,

Kamala Tower,Khalidiya,

Zayed

ABU DHABI GLOBAL MARKET (ADGM)

office 2712, Level 27,

Addax Tower,

Al, Reem Island,

Abu Dhabi

MASDAR CITY

FD – First Floor

Incubator Building

Masdar City,

Abu Dhabi

SHARJAH

Office No 1804

Business Tower, Corniche St,

Al Majaz 2 ,

Sharjah

SAIF ZONE

Office No: Q1-04-006/A

P.O Box 513424

SAIF Zone,

Sharjah

communications@evasconstantin.com

communications@evasconstantin.com